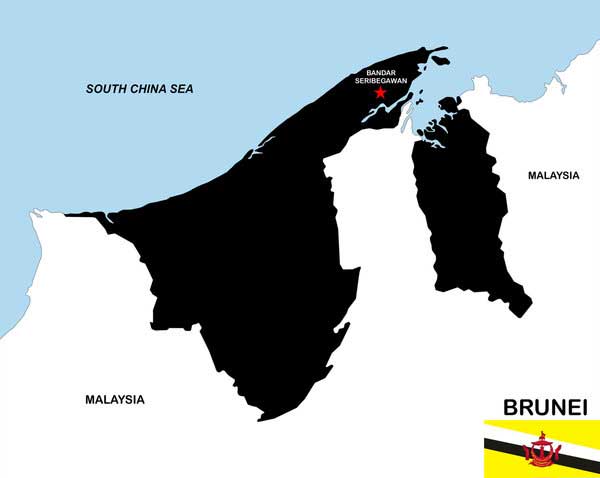

Brunei, a tiny country in Southeast Asia, boasts a unique economic system that has raised eyebrows and questions worldwide. With a land area of less than 6,000 square kilometers and a population of 450,000, it’s one of the smallest nations in Asia. However, what makes Brunei stand out is its welfare state model, where the government covers nearly all aspects of its citizens’ lives, from healthcare to education, and even subsidized housing. Moreover, here’s the twist – Brunei citizens don’t pay taxes! In this article, we delve into the intricacies of Brunei’s economic model, explore the resource curse, and examine the government’s efforts to diversify its economy.

The Petroleum Windfall and Brunei’s Economic Rise

Brunei’s Economic System:

Brunei’s economy relies heavily on its oil and gas reserves, making it the fourth-largest oil producer in Southeast Asia and the ninth-largest exporter of liquefied natural gas globally. The discovery of oil in a developing economy may seem like a blessing, but it has its potential pitfalls. This scenario often leads to a phenomenon known as the “resource curse.”

Understanding the Resource Curse

The Resource Curse:

Most oil-rich economies, including Brunei, face challenges associated with the resource curse. These challenges include poor growth in non-resource sectors, limited democracy, and worse development outcomes compared to nations with fewer natural resources. Additionally, these economies struggle to diversify, and oil booms often result in wasteful spending.

Brunei’s Welfare State and Taxation Dynamics

The Welfare State:

The petroleum industry’s success has allowed Brunei to create a welfare state where citizens don’t pay taxes. While this might sound like a dream come true, it has unintended consequences. Taxation establishes a fiscal contract between the state and its citizens, promoting accountability. However, most oil-rich nations suffer from a participation deficit, disrupting this contract and leading to a lack of citizen engagement.

Addressing the Accountability Gap

Diversifying Oil Wealth:

Brunei has taken steps to address the accountability gap. It invests a significant portion of its oil revenue into a sovereign wealth fund called the Brunei Investment Agency. However, this agency lacks transparency regarding its investments and historical returns. Economists have proposed models like the “Oil to Cash” initiative to ensure responsible oil wealth management and development-friendly spending.

Learning from Alaska’s Success

Lessons from Alaska:

The “Oil to Cash” model has been successfully implemented in Alaska. The Alaska Permanent Fund, created by the state’s citizens, distributes a share of oil revenues to eligible residents as an annual dividend. This fund has fostered intergenerational equality and renewable revenue despite diminishing non-renewable resources.

The Importance of Economic Diversification

Diversifying the Economy:

While Brunei has made strides in diversifying its economy, there is still work to be done. Oil and gas sales represent a substantial portion of the country’s GDP and exports, creating concerns about future GDP growth not keeping up with population growth. Efforts to improve the matching of education and skills with industry needs are essential for economic diversification.

Youth Unemployment and the Rentier Mentality

Youth Unemployment Challenges:

Brunei faces a critical issue of youth unemployment, with a rate of 23.4% in 2021. A mismatch between job seeker expectations, job opportunities, and employer skill requirements contributes to this problem. The generous social welfare programs make unemployment more comfortable, but this has led to a rentier mentality where youth aim for high-paying government jobs.

Promoting Entrepreneurism and Economic Growth

Promoting Entrepreneurship:

To combat the rentier mentality and encourage economic diversification, Brunei must focus on promoting entrepreneurship among its youth. Encouraging young individuals to start small businesses can help diversify the economy and prepare for a future without oil reserves.

Conclusion:

Brunei’s economic model, driven by oil and gas, presents unique challenges, including the resource curse and youth unemployment. However, the government’s efforts to diversify the economy and promote entrepreneurship among the younger population offer hope for a future beyond oil. As Brunei navigates these economic waters, it can draw valuable lessons from successful models like Alaska and Norway, proving that the resource curse is not an inescapable destiny.